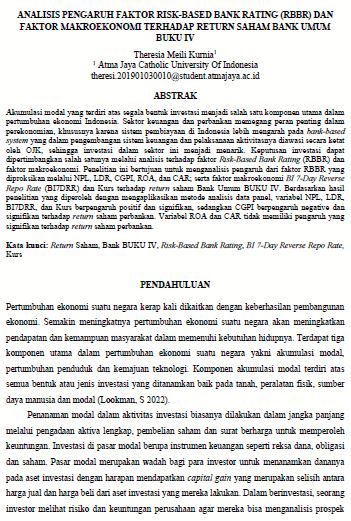

ANALISIS PENGARUH FAKTOR RISK-BASED BANK RATING (RBBR) DAN FAKTOR MAKROEKONOMI TERHADAP RETURN SAHAM BANK UMUM BUKU IV

DOI:

https://doi.org/10.25170/jrema.v2i1.4943Abstract

Akumulasi modal yang terdiri atas segala bentuk investasi menjadi salah satu komponen utama dalam pertumbuhan ekonomi Indonesia. Sektor keuangan dan perbankan memegang peran penting dalam perekonomian, khususnya karena sistem pembiayaan di Indonesia lebih mengarah pada bank-based system yang dalam pengembangan sistem keuangan dan pelaksanaan aktivitasnya diawasi secara ketat oleh OJK, sehingga investasi dalam sektor ini menjadi menarik. Keputusan investasi dapat dipertimbangkan salah satunya melalui analisis terhadap faktor Risk-Based Bank Rating (RBBR) dan faktor makroekonomi. Penelitian ini bertujuan untuk menganalisis pengaruh dari faktor RBBR yang diproksikan melalui NPL, LDR, CGPI, ROA, dan CAR; serta faktor makroekonomi BI 7-Day Reverse Repo Rate (BI7DRR) dan Kurs terhadap return saham Bank Umum BUKU IV. Berdasarkan hasil penelitian yang diperoleh dengan mengaplikasikan metode analisis data panel, variabel NPL, LDR, BI7DRR, dan Kurs berpengaruh positif dan signifikan, sedangkan CGPI berpengaruh negative dan signifikan terhadap return saham perbankan. Variabel ROA dan CAR tidak memiliki pengaruh yang signifikan terhadap return saham perbankan.

References

Bimo, I. D., Silalahi, E. E., & Kusumadewi, N. L. G. L. (2022). Corporate governance and investment efficiency in Indonesia: The moderating role of industry competition. Journal of Financial Reporting and Accounting, 20(2), 371-384.

Blau, B. M., Brough, T. J., & Griffith, T. G. 2017. Bank opacity and the efficiency of stock prices. Journal of Banking & Finance, 76, 32–47. https://doi.org/10. 1016/j.jbankfin.2016.11.026

Candra, A. 2021. The Effect Of Decreasing Bi Interest Rate 2020 On Abnormal Return And Trading Volume Activity In Islamic Economic Perspective (Study of Companies Listed on IDX 30).

http://repository.radenintan.ac.id/16992/

Cannon, William dan McCarthy. 2008.Pemasaran Dasar. Jakarta: Penerbit

Salemba Empat

Daud, I., & Sihombing, P. 2022. Determinant Analysis of Macroeconomic Effect on Bank Stock Return Book 4 on the Indonesia Stock Exchange. Budapest International Research and Critics Institute (BIRCI-Journal): Humanities and Social Sciences, 5(2).

Dendawijaya, Lukman. 2000. Manjemen Perbankan. Jakarta: Ghallia Indonesia

Dharmastuti, C. F. (2016). Faktor Eksternal dan Internal yang Mempengaruhi Return Investasi Produk Reksa Dana Campuran di Indonesia. Media Ekonomi dan Manajemen, 29(2).

Dharmastuti, C. F., & Laurentxius, J. (2021). Factors and Benefits that Affect Lender's Interest in Giving Loans in Peer to Peer (P2P) Lending Platform. Binus Business Review, 12(2), 121-130

Duong, T. T. N., Phan, H. T., Hoang, T. N., & Vo, T. T. T. 2020. The Effect of Financial Restructuring on the Overall Financial Performance of the Commercial Banks in Vietnam. The Journal of Asian Finance, Economics and Business, 7(9), 75-84.

Fahmi, I., 2014. Corporate financial management and capital market. Jakarta: Mitra Wacana Media.

Febrianti, V. D., & Saadah, S. (2023). Stock liquidity and stock returns: the moderating role of financial constraints. Journal of Accounting and Investment, 24(2), 292-305

Gousario, F., & Dharmastuti, C. F. (2015). Regional financial performance and human development index based on study in 20 counties/cities of level I region. The Winners, 16(2), 152-165.

Hanani, R. T., & Dharmastuti, C. F. (2015). How do corporate governance mechanisms affect a firm’s potential for bankruptcy. Risk Governance and Control: Financial Markets and Institutions, 5(1), 61-71.

Hendriko Gani. 2020. BI Cuts Benchmark Interest Rate, Stock Sector Is Ready to Arrive -Market Bisnis.com.

Hervino, A. D., Insukindro, A. S. H., & Utami, S. (2023). Monetary Reaction Function in Indonesia During Inflation Targeting Period. Jurnal Ekonomi dan Studi Pembangunan, 15, 1

Idroes, Ferry N. 2008. Manajemen Risiko Perbankan, Pemahaman Pendekatan 3 Pilar Kesepakatan Basel II Terkait Aplikasi Regulasi dan Pelaksanaannya di Indonesia. Jakarta: PT. Raja Grafindo Persada.

Jensen, M. C., & Meckling, W. H. 1976. Theory Of The Firm: Managerial Behavior, Agency Costs And Ownership Structure. Journal of Financial Economics 3, 3(4), 305–360.

Kasmir, Jakfar. 2012. Studi Kelayakan Bisnis. Edisi Revisi. Jakarta : Kencana

Karnadi, E. B., & Kusumahadi, T. A. (2021). Why Does Indonesia Have a High Covid-19 Case-Fatality Rate?. Jejak, 14(2), 272-287

Kewal, Suramaya Suci, 2012. “Pengaruh Suku Bunga, Inflasi, Kurs, dan Pertumbuhan PDB Terhadap Indeks Harga Saham Gabungan”, Jurnal Economia, Volume 8 Nomor 1, Sekolah Tinggi Ilmu Ekonomi Musi, Palembang.

Kuncoro Mudrajat dan Suhardjono, 2002, manajemen perbankan: Teori dan Aplikasi

Kusumahadi, T. A., & Permana, F. C. (2021). Impact of COVID-19 on global stock market volatility. Journal of Economic Integration, 36(1), 20-45

Krisandi, S. D., Rinaldi, H., Jaya, M., & Yuardani, A. M. (2023). KEWIRAUSAHAAN DAN PERTUMBUHAN EKONOMI INDONESIA: DYNAMIC STOCHASTIC MODELLING. Nusantara Hasana Journal, 3(1), 23-38.

Levine, R., and Zervos, S. 1998, “Stock market, banks, and economic growth”, The American Economic Review,

Vol. 88 No. 3, pp. 537-558.

Lookman, K., Pujawan, N., & Nadlifatin, R. (2022). Measuring innovative capability maturity model of trucking companies in Indonesia. Cogent Business & Management, 9(1), 2094854.

Mosey, A.C., Tommy, P., and Untu, V.N. 2018 'Pengaruh Risiko Pasar dan Risiko Kredit Terhadap Profitabilitas pada Bank Umum Bumn yang Terdapat di BEI Periode 2012-2016', Jurnal EMBA:Jurnal Riset Ekonomi, Manajemen, Bisnis dan Akuntansi, 6(3)

Murdiana, D., Adrianto, F., & Alfarisi, F. 2022. Announcement Of Reduction In Bi7drr Interest Rate For 2019 To 2021 On Abnormal Return And Abnormal Cumulative Return Of Indonesian Banking Share Share Return. Enrichment: Journal of Management, 12(3), 2418-2425.

Novalita, S. I. 2019. Pengaruh Likuiditas, Kecukupan Modal Dan Efesiensi Terhadap Return Saham Perbankan Konvensional (Doctoral dissertation, STIE Indonesia Banking School).

Otoritas Jasa Keuangan. Pengelolaan Investasi. https://www.ojk.go.id/id/kanal/pasar-modal/Pages/Pengelolaan-Investasi.aspx. Diakses pada 15 September 2022.

Oototas Jasa Keuangan. Tingkatan Skor Kredit di Sistem Layanan Informasi Keuangan (SLIK). https://sikapiuangmu.ojk.go.id/FrontEnd/CMS/Article/20597. Diakses pada 3 Oktober 2022.

Rahmani, N. A. B. (2020). Pengaruh Return On Assets (ROA), Return On Equity (ROE), Net Profit Margin (NPM), Dan Gross Profit Margin (GPM) Terhadap Harga Saham Perbankan Syariah Periode Tahun 2014-2018. HUMAN FALAH: Jurnal Studi Ekonomi dan Bisnis Islam, 7(1).

Saadah, S., & Sitanggang, M. L. (2020). Value at risk estimation of exchange rate in banking industry. Jurnal Keuangan dan Perbankan, 24(4), 474-484

Santoso, W., Yusgiantoro, I., Soedarmono, W., & Prasetyantoko, A. (2021). The bright side of market power in Asian banking: Implications of bank capitalization and financial freedom. Research in International Business and Finance, 56, 101358

Sayudha, AA, & Rasmini, NK 2021. Market Reaction to the Announcement of Decreasing Bank Indonesia's 7-Day Reverse Repo Rate. 1907 1917. https://doi.org/10.24843/EJA.2021.v31.i08.p03

Sembiring, Y. C. B. 2020. Pengaruh Kepemilikan Institusional dan Kepemilikan Manajerial Terhadap Kinerja Keuangan Pada Perusahaan Perbankan yang Terdaftar di Bursa Efek Indonesia. Jurnal Mutiara Akuntansi, 5(1), 91-100.

Sholichah, M. M., Jihadi, M., Widagdo, B., Mardiani, N., Nurjannah, D., & Aulia, Y. 2021. The Effect of RGEC and EPS on Stock Prices: Evidence from Commercial Banks in Indonesia. Journal of Asian Finance, Economics and Business, 8(8), 67-74.

Suganda, R. 2020. Event Study Theory and Discussion of Indonesian Capital Market Reaction (November Issue)

Sugianto, I. M., Pujawan, I. N., & Purnomo, J. D. T. (2023). A study of the Indonesian trucking business: Survival framework for land transport during the Covid-19 pandemic. International Journal of Disaster Risk Reduction, 84, 103451.

Suharto, Ippolita. 2015. Analisis Pengaruh Corporate Social Responsibility Dan

Good Corporate Governance Terhadap Nilai Perusahaan (Study Empiris

Pada Perusahaan Sektor Manufaktur Yang Terdaftar di BEI Periode

-2013). Semarang: Universitas Negri Semarang.

Todaro, Michael P. Pembangunan Ekonomi di Dunia Ketiga. Erlangga. Jakarta, 1998.

Utami, V. W., & Kartika, R. 2020. Investasi Saham pada Sektor Perbankan adalah Pilihan yang Tepat Bagi Investor di Pasar Modal. Jurnal Sains Sosio Humaniora, 4(2), 894-897.

Utomo, F. G. R., & Saadah, S. (2022). Exchange Rate Volatility and Economic Growth: Managed Floating and Free-Floating Regime. Jurnal Keuangan dan Perbankan, 26(1), 173-183

Warsa, M.I. U. P., & Mustanda, K. 2016. Effect of CAR, LDR

and NPL on ROA in the banking sector on the Indonesia stock

Weli, W. (2020). Information Technology Governance Disclosure in Annual Report of Indonesia Financial Institutions. CommIT (Communication and Information Technology) Journal, 14(2), 73-80

Wismaryanto, S. D. 2013. The influence of NPL, LDR, ROA, ROE, NIM, BOPO, and CAR on stock prices in banking sub-sectors listed on the Indonesia stock exchange

in 2008–2012. Jurnal Manajemen, 3(1), 29–60.

Winarso, W., & Jaya, I. M. L. M. Macroprudential Inclusive Policy: Strategies for Banking Sustainability in Indonesia During the Covid-19. Journal of Economics, Finance and Management Studies (IJEFM)

Yasa, H. 2015. The effect of RGEC components on changes in stock prices of banking companies on the Indonesia Stock Exchange. E-Jurnal Akuntansi Universitas Udayana, 11(1), 74–89. https://ojs.unud.ac.id/index.php/Akuntansi/article/view/ 10312

Yushita, Amanita N. 2008. Implementasi Risk Management pada Industri Perbankan Nasional. Jurnal Pendidikan Akuntansi Indonesia vol VI (1) 75-86..