| ..:: MENU UTAMA ::.. |

| TEMPLATE JURNAL BALANCE |

| INDEXING |

| REVIEWER |

| SUBMISSIONS |

| CONTACT |

| EDITORIAL TEAMS |

| FOCUS AND SCOPE |

About the Journal

|

BALANCE: Jurnal Akuntansi, Auditing dan Keuangan

Jurnal BALANCE is a scientific journal published by Accounting Program Atma Jaya Catholic University of Indonesia. Jurnal Akuntansi is published twice a year in May and November with the scopes and focus of the research areas that are Accounting Topic include:

|

Registration Process in JURNAL AKUNTANSI

The registration process in Jurnal Akuntansi is conducted by sending author's data such as full name and academic degree, email, and institutional affiliation to email weli.imbiri@atmajaya.ac.id; jurnal.balance@atmajaya.ac.id. Registration can also be done via the submission menu.

The registration process in Jurnal Akuntansi is conducted by sending author's data such as full name and academic degree, email, and institutional affiliation to email weli.imbiri@atmajaya.ac.id; jurnal.balance@atmajaya.ac.id. Registration can also be done via the submission menu.

Thank you

Current Issue

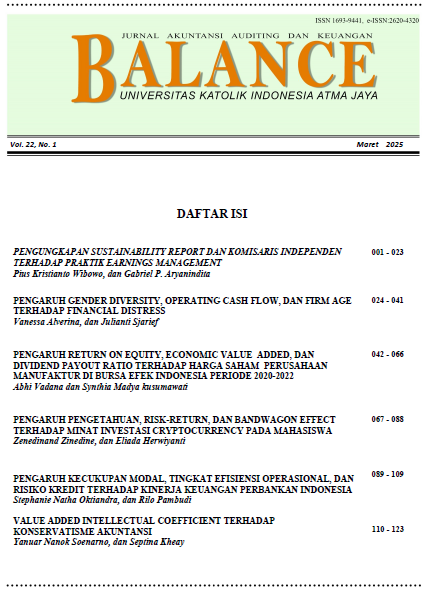

Vol. 22 No. 1 (2025): BALANCE: Jurnal Akuntansi, Auditing dan Keuangan

Published:

2025-07-15

Articles

-

PENGUNGKAPAN SUSTAINABILITY REPORT dan KOMISARIS INDEPENDEN TERHADAP PRAKTIK EARNINGS MANAGEMENT

Abstract views: 228 | PDF Downloads : 159 -

PENGARUH GENDER DIVERSITY, OPERATING CASH FLOW, DAN FIRM AGE TERHADAP FINANCIAL DISTRESS

Abstract views: 147 | PDF Downloads : 252 -

PENGARUH PENGETAHUAN, RISK-RETURN, DAN BANDWAGON EFFECT MEMPENGARUHI MINAT INVESTASI CRYPTOCURRENCY PADA MAHASISWA

Abstract views: 296 | PDF Downloads : 203 -

PENGARUH KECUKUPAN MODAL, TINGKAT EFISIENSI OPERASIONAL, DAN RISIKO KREDIT TERHADAP KINERJA KEUANGAN PERBANKAN INDONESIA

Abstract views: 464 | PDF Downloads : 451 -

VALUE ADDED INTELLECTUAL COEFFICIENT TERHADAP KONSERVATISME AKUNTANSI

Abstract views: 165 | PDF Downloads : 103