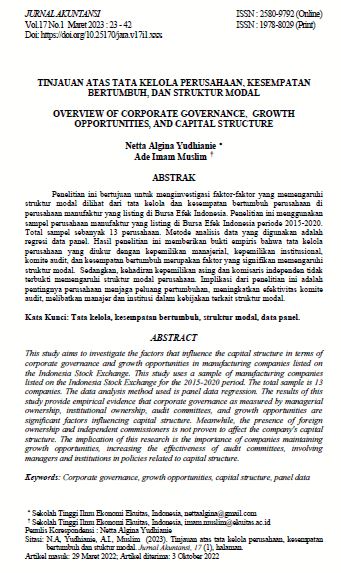

TINJAUAN ATAS TATA KELOLA PERUSAHAAN, KESEMPATAN BERTUMBUH, DAN STRUKTUR MODAL

For Manufacturing Companies Listed on the Indonesia Stock Exchange (IDX) 2015-2020

DOI:

https://doi.org/10.25170/jak.v17i1.3294Keywords:

Tata kelola, kesempatan bertumbuh, struktur modal, data panelAbstract

The purpose of this study was to determine the effect of ownership structure and growth opportunities on the capital structure of manufacturing companies listed on the Indonesia Stock Exchanged (IDX) in 2015-2020. The ownership structure used is managerial ownership, institusional ownership, foreign ownership, independent commissioner, and audit committee. Meanwhile, growth opportunity is measured using GROWTH, namely the total asset of the current period minus the total asset of the previous period and divided by the total assets of the previous period.

This research was conducted using quantitative methods with a descriptive and verificative approach, while the population in this study were manufacturing companies listed on the Indonesia Stock Exchange (IDX) in 2015-2020. The number of samples used is 13 companies that are members of manufacturing companies listed on the Indonesia Stock Exchange (IDX) in 2015-2020, using a purposive sampling technique.

The result of research conducted with a significant level of 5% indicated that the ownership structure and growth opportunity variables simultaneously significant effect on capital structure by 93.7% and the remaining 6.3% is influenced by other factors. Partially managerial ownership, institusional ownership, audit committee, and growth opportunity have a significant and significant effect on capital structure, while foreign ownership and independent commissioners has no significant effect on capital structure.

References

Dewata, E., Sari, Y., & Fithri, J. E. (2015). Pengaruh Kepemilikan Manajerial dan Kepemilikan Institusional. Sari et Al, 30(3), 175–182.

Hadiprajitno, P. B. (2014). Pengaruh Mekanisme Tata Kelola Perusahaan dan Struktur Kepemilikan terhadap Agency Cost. Diponegoro Journal of Accounting, 3(2), 669–681.

Khairani Hs, M. (2015). Pengaruh Struktur Kepemilikan Manajerial dan Growth Opportunity terhadap Struktur Modal dan Kinerja Keuangan Perusahaan (Studi pada Perusahaan Manufaktur Sektor Industri dan Konsumsi Barang Yang Terdaftar di BEI Periode 2009-2012). Journal of Chemical Information and Modeling, 53(9), 1689–1699.

Kurniawan, V. J., & Rahardjo, S. N. (2014). Pengaruh antara Tata Kelola Perusahaan (Corporate Governance) dengan Struktur Modal Perusahaan. Diponegoro Journal of Accounting, 3(3), 669–677.

Miraza, C. N., & Muniruddin, S. (2017). Pengaruh Kepemilikan Institusional, Kepemilikan Manajerial, Variabilitas Pendapatan, Corporate Tax Rate, dan Non Debt Tax Shield terhadap Struktur Modal pada Perusahaan Manufaktur yang Terdaftar di BEI Tahun 2011-2015. Jurnal Ilmiah Mahasiswa Ekonomi Akuntansi (JIMEKA), 2(3), 73–85.

Mustika, I. (2017). Pengaruh Profitabilitas, Struktur Aset Dan Growth Opportunity Terhadap Struktur Modal Perusahaan (Studi Empiris Pada Seluruh Perusahaan Yang Terdaftar Pada Bursa Efek Indonesia 2010-2014). Jurnal Akuntansi, 5(2).

Nuraini, Makhdalena, & Trisnawati, F. (2016). Struktur Modal Pada Perusahaan Manufaktur. Jurnal Economia, 3(1), 11–28.

Osvald, G., & Prasetyo, E. (2015). Pengaruh Mekanisme Tata Kelola Perusahaan dan Struktur Kepemilikan terhadap Struktur Modal (Studi Empiris pada Perusahaan Manufaktur yang Terdaftar di Bursa Efek Indonesia pada Tahun 2011-2013). Diponegoro Journal of Accounting, 4(2), 179–189.

Pradana, E. H. H. (2020). The Effect of Good Corporate Governance on Banking Profitability. Management Science Letters, 10(9), 2045–2052. https://doi.org/10.5267/j.msl.2020.2.007

Pratika, I., & Primasari, N. H. (2020). Pengaruh Komisaris Independen, Komite Audit, Ukuran Perusahaan, Leverage Dan Ukuran Kantor Akuntan Publik (Kap) Terhadap Integritas Laporan Keuangan. Jurnal Akuntansi dan Keuangan, 9(2), 109-120.

Primadhanny, R. (2016). Pengaruh Struktur Kepemilikan terhadap Struktur Modal pada Perusahaan Sektor Pertambangan yang Tercatat di BEI Periode 2010-2014. Jurnal Ilmu Manajemen (JIM), 4(3), 1–9.

Primanda, A. (2018). Pengaruh Agency Cost, Ukuran Perusahaan, Struktur Kepemilikan, Dan Growth Opportunity Terhadap Struktur Modal Perusahaan Pada Industri Perdagangan, Jasa, dan Investasi yang Terdaftar di Bursa Efek Indonesia Periode 2012–2016 (Doctoral dissertation, Universitas Widyatama).

Yuliarti, F. D., & Triyonowati, T. (2020). Pengaruh Struktur Aktiva, Operating Leverage, dan Growth Opportunity Terhadap Struktur Modal. Jurnal Ilmu dan Riset Manajemen (JIRM), 9(4).

Sabrina, H. A., Rinofah, R., & Kusumawardhani, R. (2021). Pengaruh Profitabilitas, Likuiditas, Kepemilikan Institusional dan Kepemilikan Asing terhadap Struktur Modal pada Perusahaan Pertambangan yang Terdaftar di Bursa Efek Indonesia Periode 2015-2019. J-MAS (Jurnal Manajemen Dan Sains), 6(2), 315. https://doi.org/10.33087/jmas.v6i2.292

Suryadi, D. & Irwandi, I. (2021). Pengaruh Struktur Kepemilikan, Profitabilitas, Pertumbuhan Aktiva terhadap Struktur Modal dengan Leverage sebagai Variabel Moderasi. Jurnal of Economic, Management, and Accounting, 4, 96–108.

Tiara, D. & Masruhim, Muhammad Amir. (2016). Pengaruh Good Corporate Governance terhadap Struktur Modal. Laboratorium Penelitian dan Pengembangan FARMASI TROPIS Fakultas Farmasi Universitas Mualawarman, Samarinda, Kalimantan Timur, April, 5–24.

Wijaya, B. S. & Ardini, L. (2020). Pengaruh Profitabilitas, Growth Opportunity dan Firm Size terhadap Struktur Modal. Jurnal Ilmu Dan Riset Akuntansi, 9(2), 1–14.

Yofi, A. P. & Elly, S. (2018). Pengaruh Ukuran Perusahaan, Umur Perusahaan, Leverage, dan Profitabilitas terhadap Manajemen Laba (Studi pada Perusahaan Pertambangan yang Terdaftar di Bursa Efek Indonesia Periode 2014-2016). Jurnal ASET (Akuntansi Riset), 10(1), 71–82. https://doi.org/10.17509/jaset.v10i1.12571

Downloads

Published

Issue

Section

License

Copyright (c) 2023 Netta Algina Yudhianie, Ade Imam Muslim

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.

Authors who publish with this journal agree to the following terms:

- Authors retain copyright and grant the journal right of first publication with the work simultaneously licensed under a Creative Commons Attribution-ShareAlike 4.0 International License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this journal.

- Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the journal's published version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial publication in this journal.

- Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work.